The Cut Back Economy: Consumer Spending Priorities in the Face of Rising Living Costs

This article is part two of our four-part mini-series, derived from our report in partnership with Grant Thornton 'The Cut Back Economy,' which explores the impact of the cost-of-living crisis on the UK retail, leisure, and consumer sectors. Our research shows that nearly 90% of UK consumers will need to reduce their spending on non-essentials. Check out the other three parts of the series at the bottom of this page.

2 minute read

Our research shows almost 9 in 10 (86%) consumers plan to cut back their spending over the next twelve months due to the rising cost of living. Of those planning to cut back, more than a quarter (28%) intend to do so across all areas of their spending.

The scale of the Cut Back Economy varies by different subsectors across retail, leisure and consumer industries. There are different consumer spending priorities based on the nature of the purchase in terms of value and frequency (e.g. staple vs. discretionary). This article explores 4 of these industries: Food & Grocery, Fashion, Hospitality & Leisure and Holidays.

Food & Grocery

The Cut Back Economy has hit the food and grocery retail sector the hardest with 50% of UK shoppers cutting back and looking to save an average of £494, or £41 per month, on their food shop over the next year, the highest percentage of all the sectors.

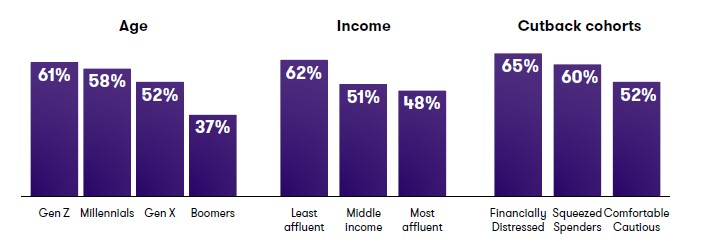

Low-income households and those under 45 are most likely to cut back on their weekly food shop, often switching to cheaper brands, making use of loyalty cards/vouchers, and buying in bulk. Even major supermarkets are seeing changes in shopper behaviour, with smaller basket sizes and spending limits. Financially Distressed households have already resorted to eating fewer or cheaper meals to cope with cost of living pressures.

Fig 1: 61% of Gen Z plan to cut back spending on food & grocery

Source: Retail Economics & Grant Thornton

Fashion

The clothing and footwear category is a top priority for consumers looking to cut back on discretionary spending during the cost-of-living crisis, with almost half of UK households planning to reduce their spending on fashion. The average household aims to cut back 10.6% of their apparel purchases.

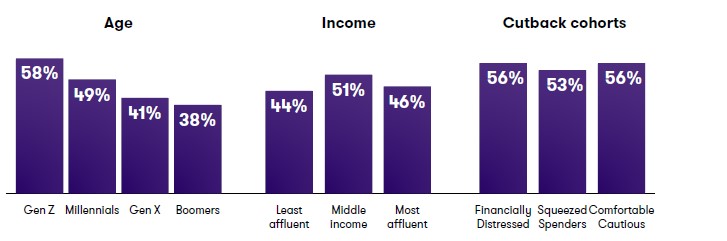

Middle-to-higher income households are expected to drive the cut back in fashion, while low-income households already typically shop around for the best deals. The challenge for fashion brands targeting younger generations is that price will become a more compelling competitive differentiator, with 58% of Gen Z shoppers planning to cut back on apparel purchases.

Fig 2: 58% of Millennials plan to cut back spending on fashion

Source: Retail Economics & Grant Thornton